Symposium Report - Global Economy and China:Urgency of Structural Reforms

Date of activity: June 2, 2016

This is the second time this year that a seminar was co-organized by Policy Alternatives Research Institute (PARI), the University of Tokyo, and IMF's Office for Asia and the Pacific (OAP). The auditorium was packed with close to 200 individuals including students of various universities. We thank all the speakers and discussants for their valuable contributions.

Session 1: Challenges to Product and Labor Market Reforms to Boost Economic Growth

Mr. Duval

Presentation slides

Speaker: Romain Duval

Advisor, Research Department, IMF

Mr. Duval stated that since the financial crisis, recovery in advanced economies has been sluggish. The IMF just revised down its growth projections worldwide and for most regions, and the uncertainty around the forecasts has increased due to several reasons. One is the risk of a disorderly pull-back of capital flows to EMs. Second is the risk stemming from China rebalancing and its large spillovers to the rest of the world. Third is the impact of weaker commodity prices on exporters, although this risk has receded slightly recently with rebound in oil and some commodity prices. The final risk is the shocks of non-economic origin in the sense of increase in armed conflicts and terrorist acts.

Further, there are some deeper forces that account for weak growth. Among these deeper forces are the weak investment growth and global trade growth since the global financial crisis. This, together with slowing total factor productivity growth, means that the mild rebound in potential growth foreseen in advanced economies over the medium term will not bring growth back to the rates seen prior to crisis.

Next, he remarked that there are also series of cyclical factors driving low growth in the short-term. Indeed the world output gap number is negative. This partly explains the low inflation environment seen in advanced economies as well as in EMs. Therefore, he suggested that the two issues of lack of demand and slowing potential growth over the medium term need to be addressed jointly.

He stated that this continued weak growth and shrinking macro policy space have led to growing emphasis on structural reforms as a way to raise medium-term growth rate. Although studies have shown that reforms can raise long-term GDP per capita levels, there is little evidence about the short- to medium-term effects of the reforms.

Then, he observed that in advanced economies, the reform priorities are a mix of product market deregulation, labor market reforms, and targeted policies to boost labor force participation. Additionally, the channels through which such reforms can be beneficial over the medium terms are productivity, employment, and increasing participation of under-represented groups.

On product market reforms, in the past there has been quite a bit of such reforms. In network industries, the median degree of regulation has decreased, especially in 1990s. However, in other areas like retail trade and professional services, much less progress has happened.

Next, labor market reforms show much less action compared to product market regulation in network industries because these reforms have proven difficult to carry out and different types of institutions can sometimes deliver good performance.

The speaker stated that in the WEO chapter he wrote, they looked at the dynamic effects of reforms by constructing a new database on structural reforms.

Looking at the results on product market reforms, the first graph showed positive response of GDP to a major product market deregulation episode. The main conclusions are that these reforms pay off but this takes time (at least 2-3 years). Next, the effects of these reforms on employment are not statistically different from zero, although they look positive. On whether product market reforms can be deflationary, the estimated effect showed a negative, but statistically insignificant impact on inflation. Hence, the concern regarding deflationary effects of reforms was overstated, as other, more theoretical analysis carried out for the WEO also showed. Next, on sector level analysis of product market reforms, he stated that deregulated industries experienced an increase in productivity and output while also creating positive spillovers to other sectors through backward and forward linkages.

Mr. Duval then moved on to labor market reforms. One key finding here was the effects of labor market reforms depended on the economic conditions under which they are done. He then shared the macro and sectoral analysis of employment protection legislation reforms. It showed that during large recessions, such reforms reduced employment while during expansions they increased it.

Hence, the conclusion was such reforms are going to deliver more short-term benefits if done in good times. The alternative is that such reform can be accompanied by monetary or fiscal stimulus in order to frontload their long-term benefits. Similar effects are also seen when social benefits are cut: in a recession period this results in an increase in unemployment in the short-term, while if carried out in an expansion benefit cuts are found to quickly reduce unemployment. So one needs to pay attention to the demand effects of these kinds of changes. Next, he talked about reforms for which benefits are instead stronger in periods of recessions than in expansion periods. These include cuts in labor taxes and increases in public spending on active labor market policies, because in a recession the fiscal multipliers from such measures are larger than in an expansion.

One way to address short-term costs of reforms that have long-term benefits is through complementary macroeconomic policies. For example, job protection reforms increase incentives for firm to both layoff existing workers and recruit new ones. If the government implements fiscal stimulus simultaneously, then the former effect is more likely to dominate the latter.

The speaker then briefly stressed the need for other reforms. First, public child care policies and reducing marginal taxes on second earners, and reforms that address early retirement incentives, raise the labor force participation of women and older workers. Second, he stated there were further productivity gains to be reaped from trade liberalization, especially if accompanied with FDI liberalization. Third, the distributional effects of reforms showed that while most reforms may raise output without increasing inequality, unemployment benefit reforms were an important case for which a trade-off exists. Fourth, regarding the budgetary effects of reforms and their implications for the design of fiscal rules, there was a clear case for flexibility in fiscal rules to accommodate some reforms.

Concluding his talk, Mr. Duval stated that potential growth is declining in advanced economies which is a medium and long-term problem, and reforms can lift potential output over the medium term. Additionally, political conditions are more conducive to reforms presently than during pre-crisis period. Therefore now is a good time for reform.

However, he cautioned that the contribution of reforms to growth may be limited in the short-term, and some of them might even have short-term costs.

Given this, he suggested that it is important to complement these reforms with macroeconomic policy support where possible, and to prioritize the reforms starting with those that will have short-term benefits. One can also credibly announce now reforms that will be implemented later, which can be a strategy to frontload the long-term benefits from the reforms while alleviating their short-term costs.

Discussions

Mr. de Mooij

Presentation slides

Ruud de Mooij

Division Chief, Tax Policy Division

Fiscal Affairs Department, IMF

Mr. de Mooij emphasized the importance of understanding the short and long-run policy implications of structural reforms. He highlighted new work in IMF’s Fiscal Monitor, which addresses the importance of fiscal policies to influence long-run TFP growth through innovation. He focused on three pillars of innovation: R&D, technology transfer, and entrepreneurship. Evidence suggests that R&D externalities lead to significant benefits to the rest of the economy, calling for fiscal incentives. Also entrepreneurial entry is vital for innovation.

Next, Mr. de Mooij discussed the effective design of fiscal R&D incentives, which is a critical aspect. Many countries are introducing patent boxes, which reduce tax burden on income from intellectual property. However, the empirical analysis for four EU countries shows that these policies have sometimes had no measurable impact on R&D; and where they did have an impact, he showed that these policies are not efficient and that other fiscal incentives can yield better value for money. Next, he emphasized that many policies hamper entrepreneurship, including tax policies. Government sometimes try to address these barriers by having preferential tax treatment of small companies. However, such schemes may fall into ‘small business traps’ and thus hurt productivity growth.

Mr. Ueda

Presentation slides

Kenichi Ueda

Associate Professor, Faculty of Economics, The University of Tokyo

Mr. Ueda stated that structural reform is the most important policy for advanced economies since fiscal space is limited and monetary policy is constrained by zero interest rate. While praising Mr. Duval’s presentation, Professor Ueda also raised some concerns.

He stated that theoretical model shows long-run gains from labor and product market reforms along with short-term pains. However, regression study shows many positive effects if labor and product market reform is done during economic booms, but shows negative effects during recession. He then talked about reverse causality, which make reforms to have spurious negative effects during recession. The deeper relationship was in fact recession or crisis calls for a reform and, naturally economic growth is slow.

He also spoke about his concerns relating to credit constraints. Although the WEO chapter talks about credit constraint in both theoretical model and regression studies, it does not include financial sector structural reform as well as natural tightening of credit constraint during recessions. Next, he stated that labor market reforms mean that firms find it easier to lower wage or fire workers. However, IMF and many academics agree with labor market reforms because current continental Europe and Japan’s labor market are too rigid. But, in case of developing countries, there is little protection for workers. Hence, for developing countries, basic workers’ rights need to be established.

Mr. Ganelli

Presentation slides

Giovanni Ganelli

Deputy Head of Office, IMF Regional Office for Asia and the Pacific

In his discussion, Mr. Ganelli stated that there were two important takeaways for structural reform debate in Japan from Mr. Duval’s presentations: One, structural reform doesn’t necessarily imply short-term pain, but in fact may stimulate economy in the short-term. Second, it is important to complement structural reforms with other kind of macroeconomic stimulus. He explained that this linked well with IMF’s advice for Japan of having a comprehensive package which included structural reforms, a medium term fiscal consolidation plan as well as short-term stimulus including macroeconomic and income policies.

This comprehensive package includes increasing labor supply, corporate governance, reducing duality in labor market, and fully implementing TPP. Although Japan has progressed on many of the above issues, labor market duality is a problem for two reasons: it reduces productivity and it makes it difficult to generate wage dynamics. Hence, if Japan makes reforms of labor market duality, then it can stimulate medium term growth. Regarding corporate governance, since Japanese companies have large cash reserves, this reserve could be used more efficiently to stimulate the economy in the short term by using it as investment or as wage increases.

Next, Mr. Ganelli stated that Japan needs to stimulate wage growth to permanently get out of deflation. Some progress has been made in this aspect through public-private dialogue, where the government has been encouraging profitable companies to increase wages. However, there is a space for authorities to do more by providing a soft target for wage growth.

Comments by Mr. Romain Duval

Mr. Duval pointed out that there is not always a trade-off between short-term and medium-term effects of reforms, R&D policy being one such example where there is no short-term cost. In fact, implementing R&D policy at the current juncture of weak growth can deliver a small short-term growth gain, a larger longer-term boost. On reverse causality, he stated that his empirical analysis accounted for the fact that reforms may themselves be driven by recession.

Further, on why financial reforms were not addressed, he pointed out there is a lack of good indicators that would address complex financial sector issues that arise in advanced economies. Additionally, he explained that the existing IMF indicator of financial regulation in the paper quoted by Mr. Ueda is no longer relevant for advanced economies, but only for EMs. This is because most of the reforms captured by these indicators were made in advanced economies already in the 1980s and 1990s. On the role of credit constraints for shaping reforms’ impact, he agreed that it mattered and mentioned one finding from the WEO chapter, which was that when firms have credit constraints, they respond much less to reform, especially on the investment side.

On job protection and workers well-being, Mr. Duval stressed that it is a complex issue. He disagreed that job protection is necessarily beneficial for workers on average and emphasized that it depends on how it is designed. He stated that countries that have tight protection for regular workers have resorted a lot to temporary workers. Therefore, if this protection were made homogenous, both an increase in efficiency and a reduction in inequality could be achieved. Finally, on EMs, he stated that some issues in the chapter are not relevant for EMs, such as certain labor market reforms. For example, in EMs, the debate presently is more on how to build income insurance, not how to streamline existing social benefit systems. But other issues were highly relevant, not least product market reforms.

Question and Answer Session

Q1: In Japanese context, what would be the driver to further give incentives to reduce job security for regular workers? Also, what would be concrete steps to make it happen?

Mr. Kenichi Ueda replied that the current discussion in Japan about non-regular workers and a part of regular workers was about infringement of labor standard issues. Further, current Japanese regular workers are similar to European workers that cannot be fired easily. He agreed that regular and non-regular workers’ current labor practice needs to be harmonized.

Mr. Giovanni Ganelli replied that the authorities can reduce duality by encouraging the use of limited regular (gentei seishain) contracts which would provide more stability to non-regular workers.

Mr. Shinohara

Mr. Naoyuki Shinohara said that political aspects of the structural reform issue are an important one as well. He added there were lots of documents supporting that and Mr. Duval has worked on this in the past.

Q2: Why do IMF and European Central Bank stress on more structural reforms that might pay off in the long run but are much lower than output gap?

Mr. Romain Duval replied that there are two different sets of issues; lack of demand which shows up in a negative output gap, and potential output growth itself, which has been slowing since already before the crisis. To address these two issues there are two sets of tools; macroeconomic policies, such as monetary and fiscal to close the output gap, and structural reforms to try and boost potential growth. IMF has been pushing for the whole package precisely because they want the two sets of instruments to address the two issues.

Mr. Ruud de Mooij agreed on the need to reduce the labor market. He stated that the first recommendation would be to introduce single, open-ended contract in which employment protection is low at the beginning of the tenure, but increases gradually as one becomes senior. However, this is difficult to implement for many reasons. Another way is to use intermediate contracts which already exists. This would give more security, more career prospects, and wage bargaining power to non-regular workers and flexibility for regular workers.

Session 1

Session 2: Chinaʼs Challenges for Structural Transformation

Mr. Schipke

Presentation slides

Speaker: Alfred Schipke

IMF Senior Resident Representative for China

Mr. Schipke informed that China’s growth over the last decade has slowed down gradually. Further, this slowdown in China’s growth is accompanied by adjustment in some overcapacity sectors. Conversely, on the demand side, private consumption has been rising since 2012, which is reflected in higher disposable income. Therefore, although investments have declined slightly, it is in line with decline in national savings.

He explained that China has wide regional growth disparity with some region in recession while others doing significantly better, which lead to difficulty in policymaking. Next, the speaker informed that in terms of rebalancing, China is showing a mixed picture in the sense that the rebalancing is taking place but at slower than expected pace. However, the most challenging rebalancing part has been the issue of credit intensity and asset allocation.

In the last 1 year, China had significant net capital outflow that reflected in reserves decline, although the reserves are still adequate in China. This capital outflow was driven by other investments and outward FDI. The explanation for the outflow was Chinese corporates repaying their debt in US dollars. Recently, China seems to be trying to stabilize its exchange rate vis a vis a basket of currency.

Since the global financial crisis, China has relied on credit in conjunction with big stimulus to move the economy. This has led to sharp rise in ratio of credit to GDP. To answer questions arising out of that challenge, the IMF looked at other countries that had similar increases in the credit to GDP ratio. It showed that countries that experienced strong credit growth for prolonged period would face significant growth slowdown and that many such countries ended up with a financial crisis. Hence, there are concerns of China’s macroeconomic stability going forward.

He also argued that in China there is strong credit growth, strong investment, but growth has slowed down. This means credit is not allocated efficiently. Additionally, Chinese companies are facing pressures as seen from the increase in number of days in their debt repayment as well as in interest payments.

Next, the speaker informed that although China’s fiscal deficit for 2016 is 3% of GDP, in China a lot of the spending comes from local governments. So, IMF defined a concept called ‘augmented fiscal’ which is the combination of central government and off-balance sheet local government deficits. This augmented fiscal for China is 10%, which is concerning.

Then, Mr. Schipke moved to the topic of state-owned enterprise (SOEs). SOEs have large share of the debt that are associated with overcapacity and inefficiency in the system. Although only 22% of total output is driven by SOEs, they benefit from a lot of credit. SOEs also benefit from implicit state subsidies.

Regarding SOEs, he stated the first problem is unclear SOE ownership. There have been some talks on reforms on this, but it is still a long way. Second is developing an arms-length relationship between the government and the management of the company. However, the government plans to have a member of the party on every single board, which is disconcerting. Third problem is that SOEs have no clear objectives. The solution here would be to let non-core asset leave the company and be sold to private sector, but current reform plans are not specific. Fourth problem is many of these SOEs have semi-monopoly or oligopoly powers.

With respect to China’s overall reforms, there have been few broad documents being circulated such as the Third Plenum from 2013 and Work Plan for 2016. The government wants to foster innovation and entrepreneurship and the emphasis is also on green development.

The Chinese government has announced the growth target for 2016 to be 6.5 to 7%, which is ambitious side. It also wants to address the overcapacity sector issues, exit from nonviable SOEs, and unwind excess real estate inventory. He felt that as China goes through restructuring its economy, it needs to be prepared to calibrate macroeconomic policies to avoid sharp slowdown in short-term. However, it also should not continue stimulating the economy.

In conclusion, Mr. Schipke reiterated that the key challenge for China presently is corporate debt issue, which needs a comprehensive approach. Additionally, going forward, China will need to enforce hard budget constraints. Regarding SOEs, he felt that the government needs to define a good owner, a set of clear objectives, ensure little interference in company management, and a level-playing field. Finally, he emphasized on the fact that China needs to focus on articulating its policies in terms of clear objectives and a clear roadmap for reaching those objectives.

Discussions

Mr. Kawai

Presentation slides

Masahiro Kawai

Project Professor, Graduate School of Public Policy, The University of Tokyo

Mr. Kawai agreed that current government’s ambitious growth target for 2016 at 6.5-7% could lead to unsustainable stimulus. He then raised the question whether China’s current slowdown is cyclical or structural. Professor Kawai remarked that several prominent economists in China believed that the slowdown is cyclical, while he judged it to be structural. China faces demographic challenges with a declining production-age population and a rising old-age population. Infrastructure investment may also have peaked out. The economy is moving towards a service economy whose overall productivity tends to be lower than manufacturing.

He mentioned that in August 2015 as well as in early 2016, China saw a huge financial turmoil. The sudden devaluations of renminbi in August 2015 and the market belief of a weakening economy accelerated capital outflows. This created negative spillover effects to other economies of the world. Hence, he argued it was important for China to contain capital outflows and manage the exchange rate well.

On the issue of economic rebalancing, he stated that China had had large current account surpluses, about 10% of GDP, before the global financial crisis. That was reduced drastically after the introduction of the 4-trillion-yuan stimulus package as the investment to GDP ratio went up by 7% while the savings rate was relatively stable. Thus external rebalancing was successful, but domestic imbalances were created in the form of excessively high investment and credit growth. He remarked that now domestic rebalancing was gradually under way to reduce both investment and savings and increase consumption.

Next, he pointed that clear communication by Chinese authorities with the market is important as the lack of adequate communication aggravated the situation in August 2015 as well as in early 2016. However, clear and transparent policy communication is a challenge for Chinese authorities as they have the tradition of keeping things secret and not explaining their policy intentions adequately.

Mr. Tsuyuguchi

Presentation slides

Yosuke Tsuyuguchi

Senior Advisory Officer, Shinkin Central Bank

Mr. Tsuyuguchi stated that presently, most banks in China are owned by public sectors. However, in 2015, five private banks were established by companies such as Alibaba and Tencent. The data on increase in total social financing also showed that almost 70% of non-banking sectors raised funds from traditional renminbi deposits and loan channels.

Next, he informed that the Chinese central bank, People’s Bank of China (PBOC), lowered the benchmark interest in October 2015 as well as lifted the upper limit for deposit rate. Hence, presently there is no upper or lower limit for deposit or lending rate. However, PBOC still announces the benchmark interest rate. Additionally, PBOC announced that the bank should use reasonable interest rate for lending and deposit. Hence, contrary to popular belief, he believes the rate is still regulated in China.

This means that Chinese banking sector is still owned by public sector, and so are inefficient. To compensate for that, interest rates are still regulated and interest rate gaps are kept. Additionally, capital account transactions are restricted. Under such situation, PBOC’s monetary policy is controlling amount of bank loan, and the renminbi exchange rate is controlled.

He stated the capital account restrictions are being lifted one by one. Then, it will be impossible to control the amount of loans. Therefore, central bank’s operational target of monetary policy must shift to interest rate. So, regulation on interest rate must be lifted, and renminbi exchange rate must float.

Hence, he argued that banks must be reformed to be more efficient and to pursue balance of profit and risk. However, one difficulty is the presence of Communist Party Committee in every banks in China, and they have power to decide personnel matters in these banks.

Mr. Takada

Kazunori Takada

Tokyo Bureau Chief, Bloomberg

Mr. Takada talked about two things; the importance of assessing widening growth difference in regional economies within China and the need for SOE reforms. He said China is like little countries existing within one big one with big differences in consumer behavior. Also, the growth rates in these different regions are significant. Hence, it is difficult to look at China with just one big stroke. On the topic of SOEs reform, he stated that SOEs are a drag on the economy and will remain so unless reform takes place.

Question and Answer Session

Q1: What would be the way to implement SOE reforms at a time when people are noticing income difference and concerns of social unrest are increasing without making these situations worse?

Mr. Alfred Schipke replied that from an employment point of view, it is important to not only to look at aggregate but at the local implications. However, China has a target of generating 10 million new jobs every year. Also, the government itself is currently looking at potentially dealing with about 1.8 million people that it wants to allocate. Hence, the question at the end of the day is how one wants to do the reforms.

Q2: Industrialized economies crashes at some point. However, some believe that China can avoid this by beating the system. Is it possible?

Mr. Masahiro Kawai felt that over the long run, China cannot avoid a crisis, but in the next 5 years, China has a lot of capacity to manage its destiny. Therefore, it is an opportunity for China to work on structural reforms to make sure that the probability of having crisis would be reduced in the future.

Q3: Does IMF have enough resources to bail out China if its economy fails?

Mr. Alfred Schipke responded that the importance of China for the rest of the world has been magnified over the last year because of spillovers through financial sector. However, he stated that the IMF can only provide advice. China is studying the Japanese case carefully to learn from the lessons. However, what matters most is the political economy and political economy with strong interest groups are making reforms difficult in China.

Mr. Pesek

Q4: What is the impact of China’s banking sectors reform to other East Asian countries?

Mr. Yosuke Tsuyuguchi replied that Chinese banking reform is a precondition for every financial market reforms in China. Hence, it will affect foreign exchange rate on renminbi, capital account transactions, and how PBOC will do monetary policies. Each of these reforms will have a big influence on other foreign countries, especially neighboring countries.

Mr. Kazunori Takada replied that a country that sits next to Japan regardless of how it turns will impact Japan and its neighbors. However, there is presently good understanding of where China is headed and discussions such as this are excellent in helping increase that knowledge.

Session 2

Program

| [Date] | Thursday, June 2, 2016, 14:00-17:00 |

|---|---|

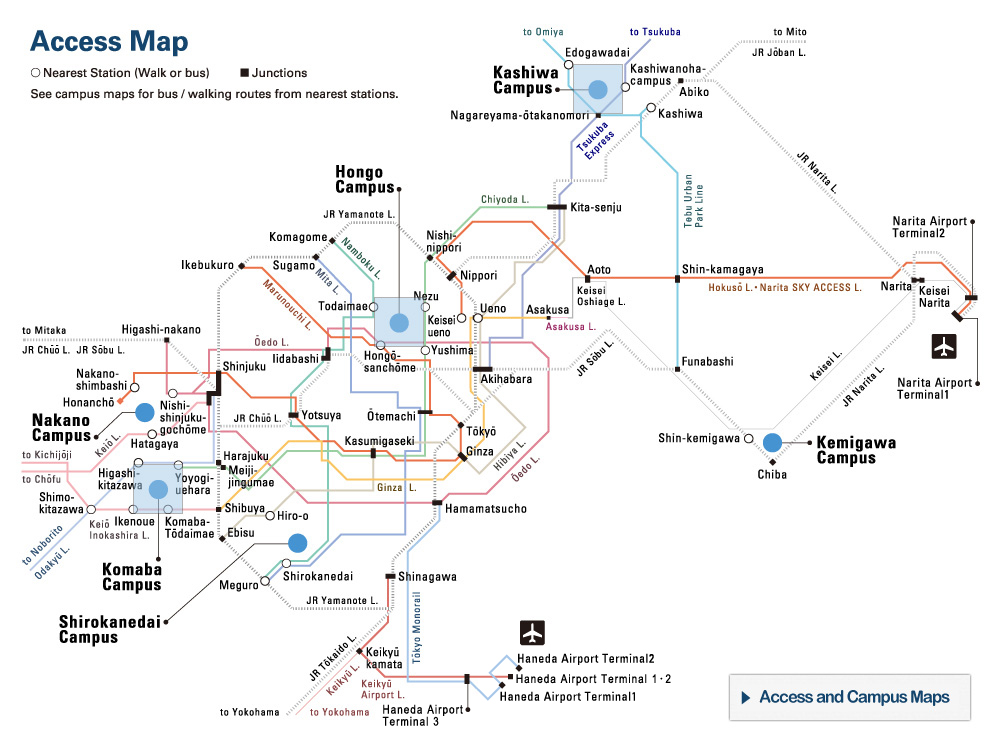

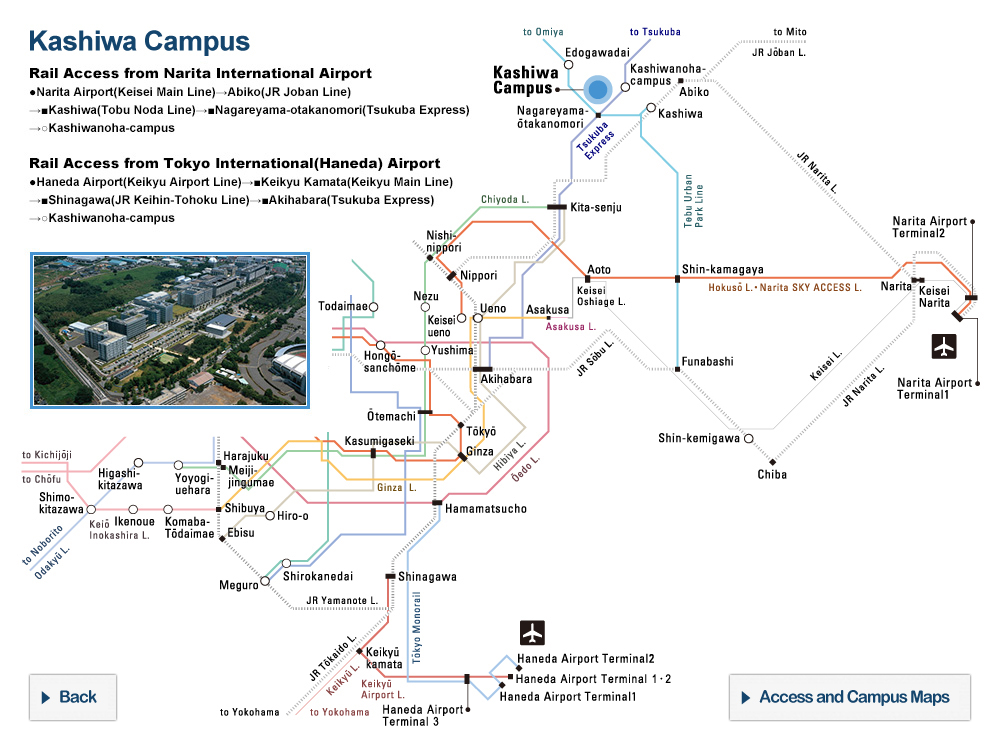

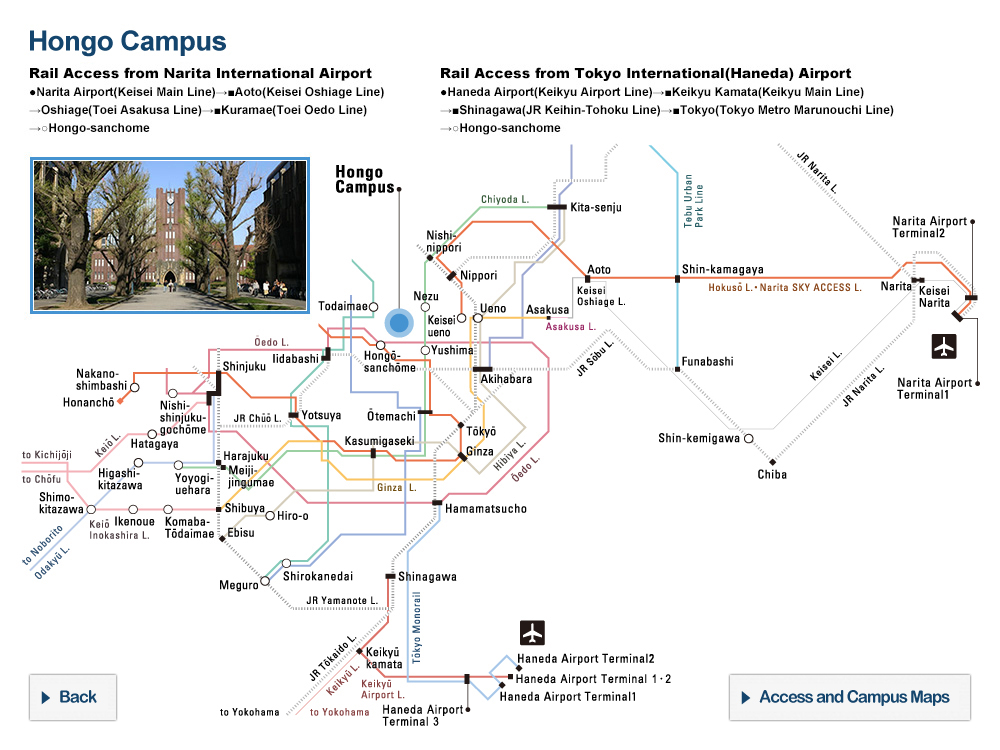

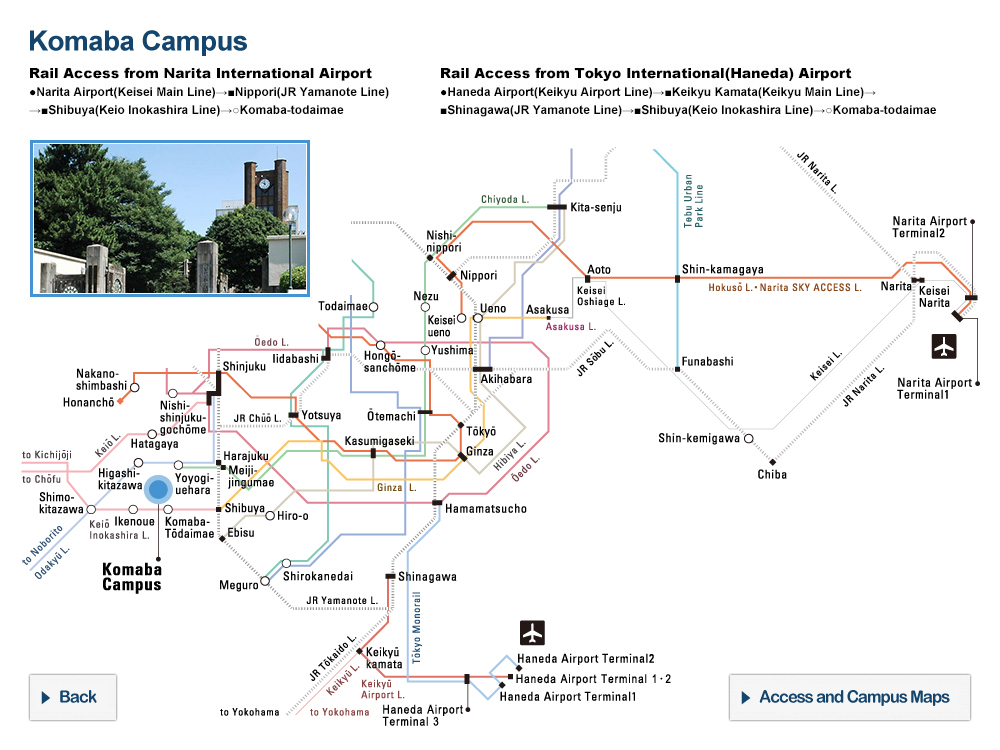

| [Venue] | Fukutake Hall, Hongo Campus of the University of Tokyo Map |

| [Hosted-by] | Policy Alternatives Research Institute (PARI) / International Monetary Fund (IMF) |

| [Language] | English/Japanese simultaneous interpretation |

| 14:00 | Session 1: Challenges to Product and Labor Market Reforms to Boost Economic Growth |

|---|---|

|

Speaker

Romain Duval, Advisor, Research Department, IMF Presentation slides Discussants

Ruud A. de Mooij, Deputy Division Chief, Tax Policy Division, Fiscal Affairs Department, IMF Presentation slides Kenichi Ueda, Associate Professor, Faculty of Economics, The University of Tokyo Presentation slides Giovanni Ganelli, Deputy Head of Office, OAP, IMF Presentation slides Moderator

Naoyuki Shinohara, Professor, Policy Alternatives Research Institute (PARI), the University of Tokyo |

|

| 15:30 | Session 2: China’s Challenges for Structural Transformation |

|

Speakers

Alfred Schipke, Senior Resident Representative in Beijing, IMF Presentation slides Discussant

Masahiro Kawai, Project Professor, Graduate School of Public Policy (GraSPP), UTokyo Presentation slides Yosuke Tsuyuguchi, Senior Advisory Officer, Shinkin Central Bank Presentation slides Kazunori Takada, Tokyo Bureau Chief, Bloomberg Moderator

William Pesek, Executive Editor, Barron's Asia |