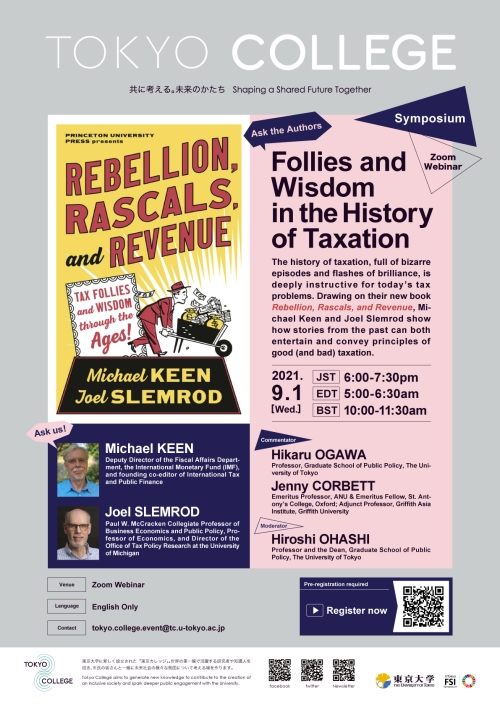

Tokyo College Event: Ask the Authors! “Follies and Wisdom in the History of Taxation” by Michael KEEN and Joel SLEMROD

Details

| Type | Lecture |

|---|---|

| Intended for | General public / Enrolled students / International students / Alumni / Companies / Academic and Administrative Staff |

| Date(s) | September 1, 2021 18:00 — 19:30 |

| Location | Online |

| Venue | Zoom Webinar |

| Entrance Fee | No charge |

| Registration Method | Advance registration required

https://us02web.zoom.us/webinar/register/WN_zmIG9P1fQryc8Dt4Mvh9dw |

| Contact | tokyo.college.event@tc.u-tokyo.ac.jp |

Abstract

The history of taxation is full of bizarre episodes, but also marked by flashes of brilliance—and deeply instructive for addressing today’s tax problems. Drawing on their new book, Rebellion, Rascals and Revenue: Tax Follies and Wisdom Through the Ages, Michael Keen and Joel Slemrod will show how tax stories from the past millennia can both entertain and painlessly convey timeless principles of good (and bad) taxation.Program

Presentations by Michael KEEN and Joel SLEMROD

Comments by OGAWA Hikaru and Jenny CORBETT

Discussion/Q&A from audience – Moderated by OHASHI Hiroshi

Speakers Profile

Michael KEEN

Michael Keen is a Deputy Director of the Fiscal Affairs Department at the International Monetary Fund, where he was previously Head of the Tax Policy Division. Before joining the Fund, he was Professor of Economics at the University of Essex, and Visiting Professor at Queens University (Canada) and Kyoto University (Japan).

He is the co-author of books on The Modern VAT and Taxing Profits in a Global Economy, and has co-edited books on Digital Revolutions in Public Finance, Inequality and Fiscal Policy, Mitigating Climate Change and others on the taxation of petroleum and minerals, customs administration and labor market institutions.

MIchael was President of the International Institute of Public Finance from 2003 to 2006, was awarded the CESifo Musgrave Prize in 2010, and in 2018 received from the National Tax Association of the United States its most prestigious award, the Daniel M. Holland Medal for distinguished lifetime contributions to the study and practice of public finance.

He is the founding co-editor of International Tax and Public Finance, served as Associate Editor on the Review of Economic Studies and on the editorial boards of the Journal of Public Economics, American Economic Journal: Economic Policy, Economic Policy and many other journals, as well as on the advisory boards of several academic institutions.

Joel SLEMROD

Joel Slemrod is the Paul W. McCracken Collegiate Professor of Business Economics and Public Policy at the Stephen M. Ross School of Business at the University of Michigan, and Professor of Economics in the Department of Economics. He also serves as Director of the Office of Tax Policy Research, an interdisciplinary research center.

He is the author of several books, among them Taxing Ourselves: A Citizen’s Guide to the Great Debate Over Tax Reform (with Jon Bakija), which has gone through five editions and been translated into Chinese and Japanese; Tax Systems (with Christian Gillitzer); and Taxes in America: What Everyone Needs to Know (with Leonard Burman). Most recently, in 2021 he co-authored with Michael Keen Rebellion, Rascals, and Revenue: Tax Follies and Wisdom through the Ages.

Slemrod was the president of the National Tax Association in 2005-2006 and was president of the International Institute of Public Finance from 2015 to 2018. In 2012, he received from the National Tax Association its most prestigious award, the Daniel M. Holland Medal for distinguished lifetime contributions to the study and practice of public finance. From 1992 to 1998, Slemrod was editor of the National Tax Journal and was co-editor of the Journal of Public Economics from 2006 to 2010.