Symposium "Japan's Economic Challenges and Structural Reform Options - IMF Views" Report

Date of activity: January 18, 2016

Session 1: Japan's Economic Challenges - Speech by Mr. Everaert

Mr. Everaert

Presentation slides

Luc Everaert of the IMF's Asia Pacific Department gave the first presentation on Japan’s Economic Challenges.

1. Global Outlook and Risks

Mr. Everaert said the key developments shaping the global outlook were: (i) differences in monetary policies and monetary policy exits, (ii) China's rebalancing, (iii) global trade slowdown, and (iv) commodity price volatility. Each of the areas carries risks for a relatively weak global economy. Economic growth in the advanced economies is in part due to growth in the Japanese economy from 0.6% to 1%. Emerging economies are still weaker in certain parts of the world.

(i) Monetary Policies

In the US, policy rates have increased. The development of central banks' balance sheets shows the US Fed has stopped quantitative easing and added an increase in federal funds rates. However, a lot of uncertainty still remains.

Internationally, the ECB's balance sheet expanded for some time and later contracted. Currently, the ECB has resumed its monetary expansion. On the other hand, the Bank of Japan has been steady in its approach. Its balance sheet has been expanding rapidly.

The main lesson to draw here is that it is extremely important for the central bank authorities to effectively communicate policy intentions to the market. Improvement in communication frameworks is necessary to reduce further risk.

(ii) China's Rebalancing

Rebalancing of China is a good thing. It has been ongoing for some time. The share of the services sector is rapidly increasing, and the increase in share of consumption has become the driving force behind economic growth.

Rebalancing of China has trade implications. Trade growth in Asia has been very subdued. The role of China was prominent in intermediate goods; however, there is a decrease in the growth of these goods. Consumption and capital goods, although expanding rapidly, are not sufficient to drive global trade. The slowdown in the growth rate of prominent goods could be larger than anticipated and could lead to further weakness in trade.

(iii) Trade Slowdown

Trade slowdown has been greater than China rebalancing. There is a decline in import elasticity of advanced economies, but it is more pronounced in emerging markets. Income elasticity of import demand for China has also declined.

(iv) Commodity Price Volatility

With low oil prices and increasing oil production and inventories, oil exporters have scaled back their expenditure. Investment in the energy sector could stall and trigger bankruptcies.

Finally, there is a slowdown in global inflation. Generalized factors such as slowdown in demand, secular stagnation, weakness in wage growth, and cyclical factors such as oil price have played roles in headline inflation. Advanced economies have headline inflation below 2%. Almost 60% of countries have headline inflation below 1%, and in some cases, inflation expectation is close to zero.

2. Economic Prospects for Japan

The overall prospects for the Japanese economy are favorable. Growth increased slowly from 0.6% in 2015 to 1%. The consumption tax increase in 2017 is expected to dampen the outlook somewhat. However, it is hoped that the recovery will resume partly in the run-up to the 2020 Olympics. The outlook is favorable, but fragile. A small shock could push the economy into contraction.

The outlook for the Japanese economy is not robust. Many indicators are positive, but the momentum is not very strong. The financial condition in Japan is favorable with low interest rates, smaller corporate bond spreads, and negative real interest rates, but there has been no strong growth response. Portfolio rebalancing shows mixed results. Although public pensions and households helped in portfolio rebalancing, other intermediaries have not done so. While overall credit is picking up, the growth rate of credit to individuals has slowed down. Even though the environment is favorable for investment, investment is relatively weak.

The labor market looks extremely tight with the job openings to applications ratio at a historical high. The unemployment rate has declined rapidly. Female labor participation is increasing. The labor market is good in terms of quantities, but it has not led to strong consumption. One explanation for lack of consumption could be that the real income of employees has not significantly increased. It was also affected by the consumption tax increase. There has been a gentle increase in real compensation over the last couple of quarters, which could lead to the strengthening of consumption.

On the inflation front, there has been some progress in lifting inflation from lower levels. However, headline inflation remains close to zero. In the near term, the inflation outlook is rather subdued, although it could be a temporary slowdown.

3. Policies: IMF Staff Advice

Despite the favorable outlook for Japan, Japan has not shown stronger growth. One of the key factors affecting it is the demographics. The demographic outlook for Japan indicates fairly weak labor input. Labor input has been negative since the late '90s. Therefore, the potential growth of Japan has decreased from 4% in the late '80s to less than 0.5% at present.

Looking ahead, there are strong negative trends in the labor force, which would reduce GDP by 8%. This weak outlook gives signals to the corporate sector that markets in Japan will not expand much, thereby making it difficult for the corporate sector to have ambitious domestic investment.

Structural reforms could compensate some weakening of the outlook. In Japan, total factor productivity growth is holding up relatively well. The male labor participation rate is among the highest in the world. The female participation rate is rapidly increasing. It is important, although not easy, to carry out additional structural reforms.

In Japan, potential reforms, all combined, are estimated to increase GDP by 12%. Along with improvement in female labor participation, there is greater scope for foreign workers' participation to deal with adverse dynamics. Rapid progress with trade integration would be a good factor for driving growth.

To sum up, advising the Japanese economy is challenging. Japan already has high income. It is facing strong adverse population dynamics. The Bank of Japan has a very expansionary monetary policy in place already. The question here is how effective the policy is and whether it is bumping into the limits. Japan has also used a lot of its fiscal space as public debt is extremely high.

One of the underlying issues is that wage price dynamics are weak. The wage pressures are not strong, despite all the reforms and tightened labor markets. There is a need for stronger structural policies and reforms. The government is doing a good job, yet more work is needed, particularly in the areas of trade integration and worker participation. Japan needs to continue with fiscal consolidation in a credible manner. Japan should adopt more medium-term fiscal frameworks and avoid going through supplementary budgets each year to adjust the policy according to cyclical economic conditions.

With regards to monetary policy, the accommodative policy needs to continue, but there should not be a sole reliance on monetary policy. Coordination and integration with other policies is critical.

On income policy, the government's push on the minimum wage front is appreciated. It is important to create a nominal price pressure in the system. There is a need for a coordination mechanism to raise both wages and prices and achieve favorable inflation dynamics.

Finally, the financial system in Japan is large, but probably not dynamic. Recently, the most dynamism has been in lending overseas, which would not help the Japanese economy much. Japan could implement a few measures in the area to help the reforms.

Session 1: Japan's Economic Challenges - Presentation by Mr. Kanno

Mr. Kanno

Presentation slides

In his presentation, Masaaki Kanno, Chief Economist of J. P. Morgan, posed a different view on the policy side. Over the past two decades, Japan has been suffering from low growth mainly due to four factors; (i) lack of population growth, (ii) lack of productivity on capital growth, (iii) labor shortage and (iv) total factor productivity. These four factors need to be addressed to increase the growth rate.

The biggest drag on the Japanese economy is the lack of population growth. Japanese companies are not excited about the outlook of domestic market expansion and have been going overseas for business. Allocation of corporate profits is inappropriate and there is a need for stronger corporate governance.

Labor allocation is not optimal and has to be changed. As the total size of resources is fixed, Japan needs to reallocate capital and labor resources away from inefficient industries to more efficient industries.

Mr. Kanno gave four comments on the IMF presentation.

1. Monetary Policy

Japan's monetary policy has been playing an important role, but its role is to buy time. While the monetary policy is buying time, politicians need to do two things: growth promotion and fiscal consolidation. On the growth side, focus needs to be on capital, labor and technology.

Regarding individual issues, the most effective transmission channel of Quantitative and Qualitative Monetary Easing (QQE) was through massive yen depreciation. With the weakened yen, corporate profits surged, stock prices rose, and there was a rise in property prices.

With no sign of economic recovery, probably in a couple of years, the yen weakness may be behind us, with a downside risk on stock prices.

The BOJ (Bank of Japan)'s balance sheet has been growing. If the BOJ continues its current policy for 2 years, its balance sheet would increase to 100% of the GDP. The BOJ started QQE as a short-term strategy; however, the 2% inflation rate could not be reached. Therefore, the BOJ changed its strategy from pre-emptive to longer term. However, if the BOJ becomes less aggressive, the yen will appreciate.

Marginal effectiveness of asset purchases is diminishing. If the BOJ increased asset purchases, the marginal effectiveness of QQE could wane.

The interest rate on excess reserves (IOER) cut (negative rate policy) should not be ruled out, although it could have negative impacts on financial stability by killing the Japanese Government Bond (JGB) market. The QQE could have spoiled the government by lowering debt-service costs, thereby discouraging the government from promoting fiscal consolidation.

2. Corporate Behavior

There is a need to increase capital expenditure (CAPEX) in Japan. Further deregulation is needed. However, China's excess production capacity weighs on Japan's CAPEX in the manufacturing sector. The IMF may have policy recommendations to solve China's excess capacity problem.

Considering the limited growth of the domestic market and CAPEX, foreign worker participation is needed. Rises in female and elderly worker participation are not sufficient on their own.

3. Labor Market

The main reason why wage rates are growing slowly is that the labor market has not tightened enough. Labor mismatch prevents wage rates from rising rapidly. Increasing labor mobility and reducing labor market duality is necessary. However, to do so, labor laws overprotecting regular workers need to change.

4. Inflation Rate

Regarding inflation, a 2% inflation rate will not be achieved anytime soon. With the fall in oil prices and yen appreciation, there is a greater risk of decrease in the inflation rate. In the meantime, the inflation rate in processed foods has risen owing to no competition from China. Japan's food industries are optimistic that food prices will rise in the future.

Session 1: Japan's Economic Challenges - Presentation by Mr. Yoshida

Mr. Yoshida

Mr. Akihiko Yoshida, in his presentation, focused on the government's perspectives on the current state of the Japanese economy and policies proposed to overcome challenges.

1. Current State of the Japanese Economy: Government's Perspective

Japan is in moderate recovery with weaknesses in certain areas. The Japanese economy will continue its recovery trend with the support of various policy measures amid improving labor and income environments.

According to the government's official economic outlook, the estimate for FY2015 real GDP growth is 1.2% followed by 1.7% for FY2016. The outlook reflects prospects of improvement in private consumption amid the tightening labor market as well as an increase in business investment.

Both outlook figures for FY2015 and FY2016 are above the potential GDP growth of 0.8% estimated by the government. In short, the Japanese economy is doing pretty well.

2. Domestic and External Factors Impacting the Japanese Economy

There are several domestic and external risks to the baseline scenario suggested by the government. One domestic factor is whether wages will increase as expected. Recent developments are encouraging. The latest jobs-to-applicants ratio was at a historical high at 1.25. The unemployment rate was comparatively low at 3.3%. Wages increased by 2.2% in 2015. The minimum wage was increased by 18 yen or 2.3%, the largest increase since 2002. The government is targeting a national average of a minimum wage of 1000 yen in the future through successive annual increases of approximately 3%.

Another domestic factor is business investment. The latest data on business investment is better than expected.

One of the precarious external factors impacting the economy is a decision by the US Fed to raise policy rates. One would need to carefully monitor the impact of this on emerging economies, especially those with macroeconomic vulnerability.

Development in China is another risk factor. The Shanghai stock market fell by 7% in a day and trading was temporarily suspended. Possible factors behind such market turmoil included concerns among investors for capital outflow as well as uncertainty over the Chinese economy and its economic policies. Nonetheless, the fundamentals of the Japanese economy are good and Japan need not overreact to day-to-day movements in the Chinese financial markets.

The rapid decline in oil prices is spreading negative sentiments throughout the global financial markets. However, Japan could benefit from lower oil prices through improvements in trade.

3. Proposed Policies by the Japanese Government

The Japanese government submitted the FY2015 supplementary budget to the Diet in January. The expenditure size of the budget is 3.5 trillion yen, and it is projected to lift Japan's GDP by 0.6%.

Over the medium term, Japan is on track to achieve the 2015 target of halving its primary deficit. In the fiscal consolidation plan 2015, the government set up the interim benchmark of 1% primary deficit for FY2018 to be anchored through containing the total increase in the Central Government's expenditure within 1.6 trillion yen. Building on the interim benchmark and through additional measures, the government aims to achieve primary surplus by 2020, thereby steadily reducing the public debt to GDP ratio.

On monetary policy, the Bank of Japan decided to smoothly implement large-scale asset purchases under QQE. The BOJ will continue with the QQE aiming to achieve the price stability target of 2%.

4. Structural Reforms by the Japanese Government

In June 2015, the government announced a revised revitalization strategy committed to putting forward "Revolution in productivity through pro-active investment" and "local Abenomics." Specific measures include the further strengthening of corporate governance and promoting utilization of ICT. And in September last year, the Prime Minister announced three new "arrows": (i) a nominal GDP of 600 trillion yen, (ii) a desirable birth rate of 1.8, and (iii) no one forced to leave jobs for nursing care.

With the success of Abenomics, Japan is close to getting out of persistent deflation. However, in the longer term, Japan faces many challenges, including the shrinking and aging of its population.

Implementing prudent macroeconomic policies alone will not suffice in overcoming such challenges. Good advice from the IMF and promoting the innovative spirit of the youth are crucial.

Session 1: Japan's Economic Challenges - Discussion

Prof. Shinohara

Mr. Everaert gave his comments on Mr. Kanno's presentation. He said the monetary policy of Japan had done what was necessary. The role of the Bank of Japan is to convince market participants of its intention of keeping the policy eased long enough to generate necessary inflation. This can be done by forward guidance commitments, stepping up the purchase of assets other than government bonds, and by lengthening the maturity of assets.

On the negative interest rates, the IMF has supported the ECB's policy of generating negative interest rates, and if the BOJ decided that negative interest rates were the right tool to ease conditions further, the IMF would support the BOJ, too.

One observation is that, by keeping excess reserves remunerated, the BOJ is effectively putting a floor under the policy rates. By reducing the rates within a certain limit, BOJ could still affect further easing.

On labor market issues, the IMF does not feel that its advice on income policy is interfering with micro relationships in the labor market. Inflation is a macro issue, and the IMF's advice is to generate, at the aggregate level, macro-dynamics for inflation.

Session 1

Special Speech by Mr. Asakawa

Mr. Asakawa

Mr. Masatsugu Asakawa, Vice Minister of Finance, International Affairs, gave the keynote speech “Update on Japanese Economy and Abenomics.”

1. Global Economy at a Glance

Since the financial market turmoil stemming from Shanghai last summer, volatility has heightened in the global capital market. With private sector capital flows subdued, emerging and developing economies are facing significant challenges: they need to bring their economies back on a sustainable path and recover confidence from global investors.

In this context, much attention has been paid to China. The era of a growth rate of more than 10% is over. Economic stimuli like the 4-trillion-yuan fiscal package after the global financial crisis is no longer effective. China needs to address structural rebalancing by: (i) shifting its economy from an investment-led growth model to a consumption-led one; and (ii) reducing dependence on exports while stimulating domestic demand. China is heading in the right direction.

However, the recent turbulence in Chinese foreign exchange and equity markets has raised a renewed concern. The Chinese policy responses and communication to market participants have not been necessarily effective in containing market volatility, leading to a drop in asset prices globally, including a five-consecutive-day decline of the Nikkei market index.

China needs to undertake its capital account reforms in a well-calibrated manner and clearly communicate its policy intentions to both domestic and foreign market participants.

2. Progress in the Three "Arrows"

Abenomics consists of three policy measures, or "arrows": aggressive monetary easing, flexible fiscal policy, and structural reforms.

In April 2013, the Governor of the Bank of Japan shot the first arrow which included a large-scale purchase of JGBs, targeting an inflation rate of 2%. The program was called “quantitative and qualitative easing” (QQE).

Although an ongoing decline of crude oil prices puts downward pressure on headline-inflation, the underlying trend in inflation has been improving steadily, with the output gap narrowing and inflation expectation improving.

The second arrow is a combination of fiscal stimulus and medium-term fiscal consolidation.

Fiscal consolidation has made significant progress since Abenomics started. The FY2015 budget was successful in halving the primary deficit to GDP ratio from negative 6.6% in FY2010 to negative 3.3% in 2015.

In the medium-term fiscal consolidation plan, the government reaffirms its strong commitment to achieve a primary surplus by FY2020.

The third arrow aims to raise potential growth through a set of structural reforms such as: (i) corporate governance reform, (ii) corporate tax reform, and (iii) the empowerment of women.

3. Japanese Economy and Abenomics

The “three arrows” of Abenomics have succeeded in revitalizing the economy. The Japanese economy remains on a moderate recovery path, with a growth of 1.0%. Private consumption and private sector investment have recorded positive growth.

Looking ahead, the Japanese economy is expected to grow from 1.2% to 1.7% in FY2016. Household consumption and the labor market situation are encouraging.

In the labor market, the unemployment rate was 3.3%, while the job openings-to-applications ratio reached 1.25%. An increasing number of non-regular workers are expected to become regular workers.

Monthly wages increased by 2.2% after the spring annual wage negotiations. A sharp decline in oil prices also contributed to an increase in real wages through its positive terms-of-trade impact.

Private sector investment and corporate foreign investments continued to be strong, owing to corporate governance reforms.

4. Future Policy Agenda

Future policies are aimed at addressing structural challenges, such as the low fertility rate and aging population. According to the government estimates, the working age population declined by 10% over the past two decades.

In such context, Prime Minister Abe has announced new arrows including: (i) childcare support to improve the birth rate up to 1.8; and (ii) a social security system to prevent people from having to quit their jobs to care for family members.

The recently-submitted supplementary budget specifically focuses on the new arrows.

5. Conclusion

The Japanese government continues to decisively take policy actions under Abenomics to bring the current recovery path to a firm footing and tackle low fertility and population aging. Intellectual discussions could further provide helpful policy advice.

Session 2: Structural Reform Options—Japan's Labor Market Reform - Speech by Mr. Ganelli

Mr. Ganelli

Presentation slides

Mr. Giovanni Ganelli, Deputy Head of Office, IMF Regional Office for Asia and the Pacific, gave a presentation on Japan's Labor Market Challenges.

1. Overview

The theme of the presentation is how labor market reforms could help increase the labor force, thereby increasing medium-term potential growth. Addressing the issue of labor market duality in Japan is important for two reasons: (i) excess duality was bad for productivity, and (ii) reducing labor market duality could help generate the positive wage price dynamic needed to definitely escape deflation.

2. Boosting the Labor Force

Japan's population is aging and its labor force is shrinking. These demographics are the main factor dragging Japan's potential growth down. The current potential economic growth of 0.6% is projected to steadily decrease and converge to zero around 2030. However, if Japan were to implement structural reforms, Japan's potential growth could be revived.

3. Policies to Address Labor Shortages

Employers in Japan are facing the worst labor shortages in 20 years. The job-to-applicant ratio, at an aggregate level, is above 1, indicating severe labor shortages.

The actual hours worked, however, are declining. About 18% of non-regular workers want to do regular jobs. This means that a part of the labor shortage problem could be addressed by increasing the hours worked and by converting non-regular workers to regular positions.

In terms of female labor participation, a lot has been achieved. The participation rate has accelerated due to Abenomics. However, participation could be increased. Some distortions in the social security system discourage married women from working full-time. Eliminating such distortions is an important policy step. Also, workers could be attracted to the working pool by increasing their take-home pay.

The labor supply of elderly workers is high in Japan. Japan boasts the highest longevity in the world. Therefore, it is important that policies stay focused on keeping elderly workers attached to the labor market through pension and social security reforms.

Finally, the labor shortage problem could be addressed by increasing the foreign labor supply. The percentage of foreign labor force in Japan is 0.3%, the lowest among advanced countries. Japan could ease the entry of foreign labor by using a skill-based and sector-based approach.

4. Labor Market Duality and Productivity

Japan is facing a large duality in the labor market. Currently, 37.4% of workers are non-regular workers, and many of these workers are women. Women have lower career prospects, lower pay, and lower security. The excessive labor market duality in Japan is bad for productivity.

Contract reforms could help deal with excess duality. However, companies are reluctant to use contracts such as the limited regular worker contracts due to their unclear legal framework. Clarifying the legal framework could be significant in solving the duality problem and enhancing productivity.

5. Labor Market Duality and Wage-Price Dynamics

Reducing labor market duality could help the wage-price dynamics needed to make a definite escape from deflation. Although labor productivity growth has been rising in Japan, real-wage growth has been close to zero due to an increase in duality.

6. Policy Measures for Wage-Price Dynamics

Some of the policy options for positive wage dynamics are: raising public and minimum wages, further strengthening tax incentives for employers that increase wages, increasing the frequency of wage rounds, and applying “comply or explain” rules for wage hikes.

Session 2: Structural Reform Options—Japan's Labor Market Reform - Presentation by Dr. Miyamoto

Prof. Miyamoto

Presentation slides

Dr. Hiroaki Miyamoto, Project Associate Professor at the Graduate School of Public Policy of the University of Tokyo, commented on the presentation by Prof. Ganelli on issues facing the Japanese labor market. He reiterated the points put forth by Prof. Ganelli and made some suggestions.

The issues facing the Japanese labor market, according to the IMF, are: (i) labor shortage, (ii) labor market duality, and (iii) wage dynamics. And the measures proposed to address labor shortage problems are: (i) boost female labor force, (ii) increase the supply of elderly workers, (iii) increase foreign workers, and (iv) increase take-home pay by increasing support wages and reducing social security premiums.

In addition to these, it is important to better utilize the young labor force and reduce labor market mismatch. The employment rate among youth has been on a declining trend during the past two decades. The youth are also under inferior employment conditions; 35% of youth are part of the "working poor." The job-to-applicant ratios vary widely depending on job types, which translates into employment type and occupational mismatch in Japan, and this mismatch needs to be reduced.

The ratio of non-regular workers has increased over time. The factors behind the deepening labor market duality in Japan seem to be strict employment protection laws and slowdown of economic growth.

With regards to wage dynamism, total cash earnings have been steadily declining since the late 1990s, and compared with other advanced countries, wage is downward flexible. The reasons for wage decline in Japan are (i) an increase in non-regular workers, (ii) the bonus system, (iii) lower worker's bargaining power and weak wage indexation and (iv) an increased number of elderly workers.

The main problem is that the Japanese employment system, characterized by life-long employment, wages based on seniority, etc., ceases working well and causes serious problems. The Japanese employment system prevailed in the past thanks to rapid economic growth and a large youth population, both of which do not exist anymore.

What are some possible solutions?

First, economic growth is crucial to mitigate the current situation. Without economic growth, large employment opportunities will not be possible.

Second, having labor market reforms is critical. The labor market needs to be fair and competitive in order to use the resource reallocation function of the labor market.

Mr. Fujii

Thirdly, a more flexible labor market needs to be promoted, so that human resources are reallocated to match changes in the industrial and occupational structures. Possible ways to enhance flexibility of the labor market include enhancing opportunities for training, opening job-matching services to private sector providers, and reducing employment protection such as making explicit firing rules.

Program

| [Date] | Monday, January 18, 2016, 14:00-17:00 |

|---|---|

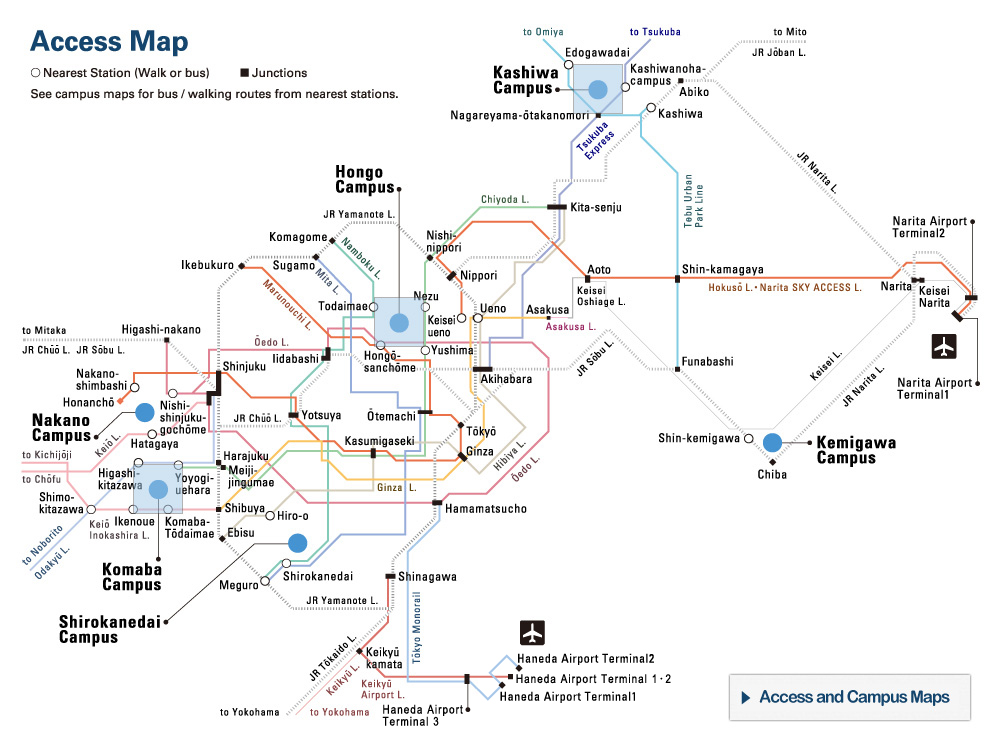

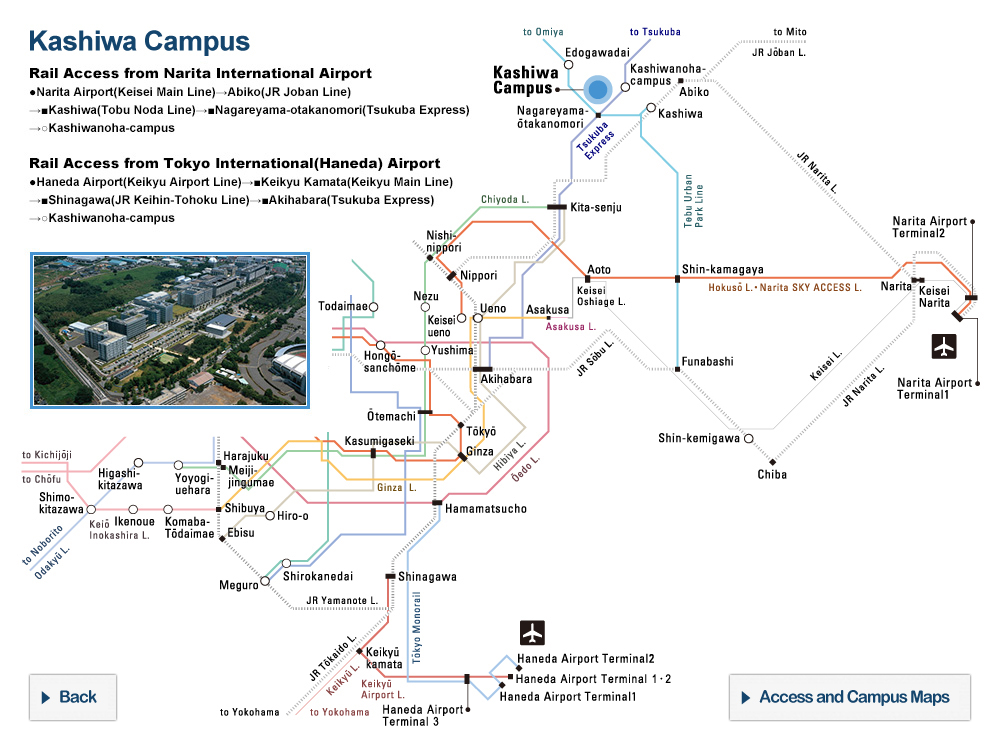

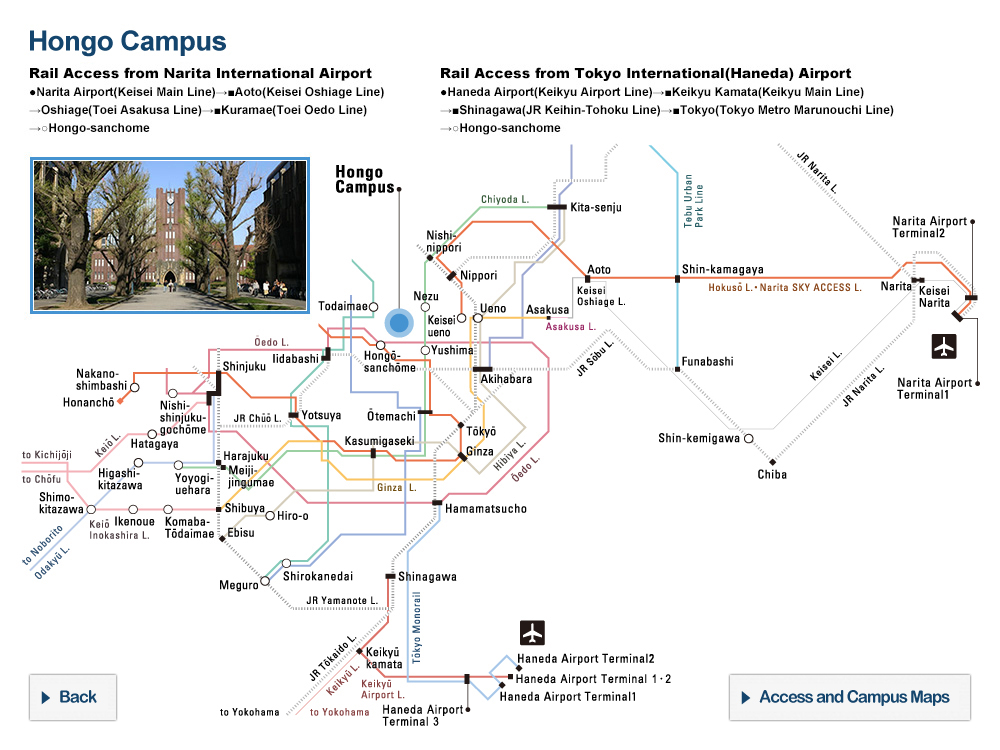

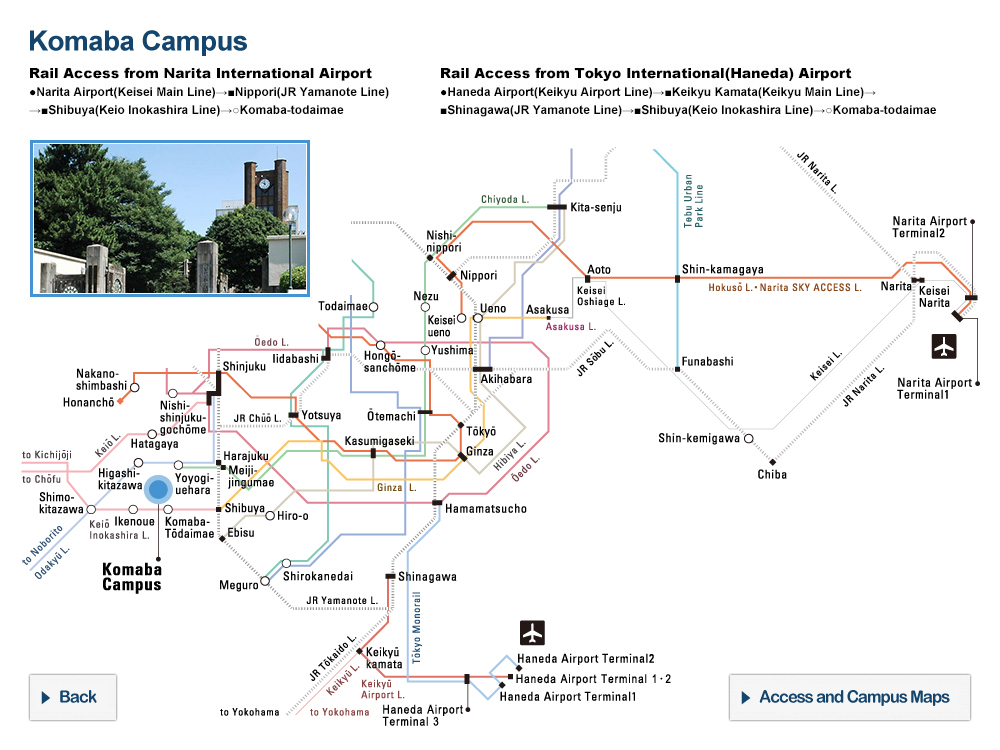

| [Venue] | Ito International Research Center, Hongo Campus of the University of Tokyo Map |

| [Hosted-by] | Policy Alternatives Research Institute (PARI) / International Monetary Fund (IMF) |

| [Language] | English/Japanese simultaneous interpretation |

| 14:00 | Session 1: Japan's Economic Challenges |

|---|---|

|

Speaker

Luc Everaert, Assistant Director, Asia and Pacific Dept. International Monetary Fund (IMF), Japan Mission Chief Presentation slides Discussants

Masaaki Kanno, Managing Director, Chief Economist, J.P. Morgan Presentation slides Akihiko Yoshida, Director, International Organizations Division, International Bureau, Ministry of Finance Moderator

Naoyuki Shinohara, Professor, Policy Alternatives Research Institute (PARI), the University of Tokyo |

|

| 15:30 | Special Speech |

|

Masatsugu Asakawa, Vice Minister of Finance for International Affairs

|

|

| 15:45 | Session 2: Structural Reform Options—Japan's Labor Market Reform |

|

Speakers

Giovanni Ganelli, Deputy Head, Regional Office for Asia & the Pacific, IMF Presentation slides Discussant

Hiroaki Miyamoto, Project Associate Prof., Graduate School of Public Policy (GraSPP), the University of Tokyo Presentation slides Moderator

Akio Fujii, Editor-in-Chief, Nikkei Asian Review, Nikkei Inc. |