Developing a Logical Approach to Economic Crises | UTOKYO VOICES 026

Developing a Logical Approach to Economic Crises

The focus of international finance has been shifting from foreign exchange to economic crises in the wake of incidents like the collapse of Lehman Brothers in 2008, and the Greek and other European debt crises that followed. Among developed countries, this trend began in Japan in the 1990s.

“I entered the Ministry of Finance back in 1991. It was in 1995, when I returned from studying in the United States, that the financial crisis struck, triggered by problems plaguing the jusen—home mortgage lending—industry in Japan. Initiatives to address these problems were debated at organizations like the G7 and Organization for Economic Co-operation and Development (OECD), in discussions in which I took part.” At the time, Associate Professor Ueda says that while listening to such discussions held between representatives of each country, most of them prominent academics, he sensed a lack of real understanding of the core issues. Back then, economic crises were viewed as occurring only in developing countries, and this was the first time a developed country had faced one since the Great Depression of 1931. For that reason, a lot remained unknown.

“I instinctively thought this was a topic worth investigating further,” says Ueda. So he left his position in the ministry and returned to the University of Chicago, where he had studied earlier. There he began research work in a field that was rarely studied in detail: the linkages between the financial theories that form part of microeconomics, and macroeconomic theories on economic crises. After obtaining a Ph.D. in Economics from the University of Chicago, he joined the Research Department of the International Monetary Fund (IMF) where he continued his research while working on IMF activities. It was during this time that Lehman Brothers filed for bankruptcy, in 2008.

“There were only a few people studying both macroeconomics and financial theory, even in the IMF Research Department, and the entire team addressed issues related to the collapse of Lehman Brothers in the United States and the European debt crises. This was the first such crisis to hit the United States since the Great Depression, and there was no one on the Federal Reserve Board (FRB) with the appropriate experience or involved in relevant research. However, the IMF had experience responding to such crises in developing countries, so we put that knowledge to work in proposing emergency measures.”

After the initial mayhem of the crisis settled, people began discussing the root causes and specific ways to address them. Most discussions focused on the “Too Big To Fail (TBTF) Problem” present throughout the financial industry, particularly with major banks tending to take on excessive risk in the knowledge that public funds would bail them out in the event of a financial crisis. In response to this, there was recognition of the need for a new global financial regulatory framework, which became the topic of vigorous debate. Ueda was involved in examining the real extent of the TBTF issue and proposing measures to deal with it.

Ueda suffered from excruciating lower back pain during his university days. For an entire year the pain was so severe that any type of activity proved harrowing. The only reprieve he got from the pain was while reading economics books, when his mind was on the profound issues they addressed. “I have never been in the best of health—two years ago I even had cancer, although that is all but cured now—so I have always wanted to live life without having any regrets. In English there is the phrase ‘muddling through,’ which comes from the notion of struggling to stay afloat in muddy water, but still making progress somehow. This is a pretty good description of my life, but I am happy that despite all this turmoil I was able to work on what I actually wanted to.”

Ueda has much the same attitude as he did 30 years ago. Even today, as a leading researcher of economic crises, he is still frustrated at the state of government policy and at research conducted by economists. This has been a key driving force behind his own work: “Research into economic crises is not that well established, even within the field of economics. There are so many ways to approach these issues—and that’s what makes the research so interesting.”

Another area that Ueda is focusing on is providing training for future researchers. “The finance ministries, central banks and other financial institutions throughout Europe and the United States have an increasing number of professional economists who are well versed in both research and actual business. But there are few people filling this role in Japan, which is clear from the lack of representation at international forums and conventions where discussions make full use of technical economics terms. I want to train economists able to play an active role at the global level.”

The approach that Professor Townsend, under whom Ueda studied at the University of Chicago, took to his work was to “conduct research without overly worrying about the tools.” So, anything that comes to mind should be jotted down using any cheap ballpoint pen you find. Some people even scribble notes on paper napkins during conversations at restaurants. Just like Professor Townsend, Ueda also uses any (usually cheap) pen at hand.

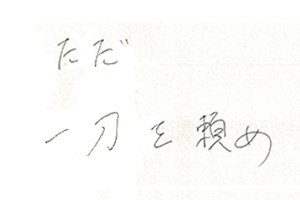

[Text: Tada ittou wo tanome ("Trust in even just a single sword")]: This is a variation of the phrase “Trust in even just a single light,” which means to take another step forward even when there is only the slightest potential ahead, and was coined by Sato Issai, a Confucian scholar during the late Edo period. ittou can mean either “a single light” or “a single sword” in Japanese, so Ueda always visualized “Trust in even just a single sword” to memorize the phrase, on the basis of training in swordsmanship making you stronger. In this way, substituting “sword” for “light” makes the phrase a closer match to how he sees things.

Kenichi Ueda

Graduated from the Faculty of Economics, the University of Tokyo in 1991, then entered the Ministry of Finance. Completed the Master’s course at the University of Chicago in 1994, and was then appointed Planning Chief of the International Finance Bureau. Entered graduate school at the University of Chicago in 1996, and acquired a Ph.D. (Economics) in 2000; appointed Economist of the International Monetary Fund (IMF) the same year. Became Senior Economist of the IMF in 2009, and appointed Associate Professor of the Graduate School of Economics, the University of Tokyo in 2014. Involved in research and education based on his own experience of responding to economic crises throughout his career. Researched the linkages between financial systems and macroeconomic activities over his 14-year tenure at the IMF Research Department. Was also a visiting researcher at the Massachusetts Institute of Technology from 2011 to 2012.

Interview date: January 24, 2018

Interview/text: Hiroshi Kikuchihara. Photos: Takuma Imamura.