Lead-lag analysis for ultra-high-frequency trading

- 1.3 Quantum AI

- 1.4 Quantum financial engineering/technologies

- 1.5 Quantum interdisciplinary sciences(Life science, Mathematics, Particle physics, Space science, Astronomy, Quantum gravity, etc.)

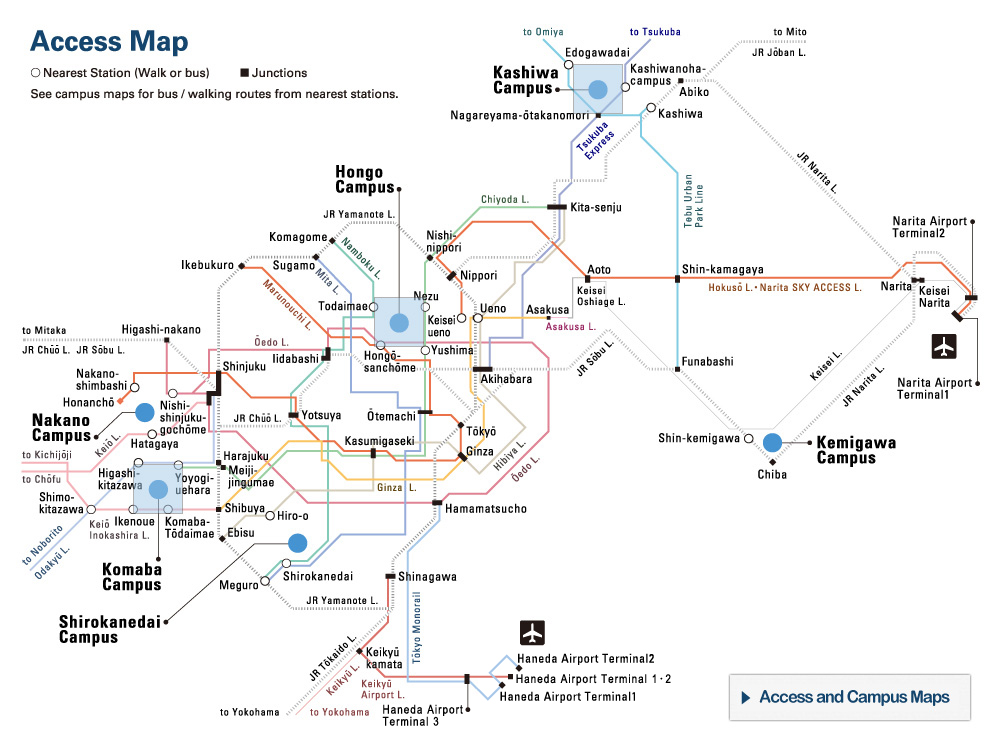

Yuta Koike

Graduate School of Mathematical Sciences

Associate Professor

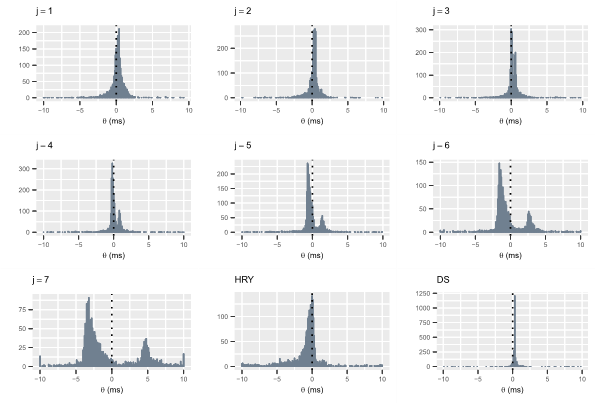

In ultra-high-frequency trading of modern financial markets conducted at sub-second frequencies, one often observes lead-lag relationships between assets, which are beyond the scope of traditional theory of financial engineering. This project aims at understanding how and why such phenomena occur.

Research collaborators

Takaki Hayashi (Professor, Keio University)

Related publications

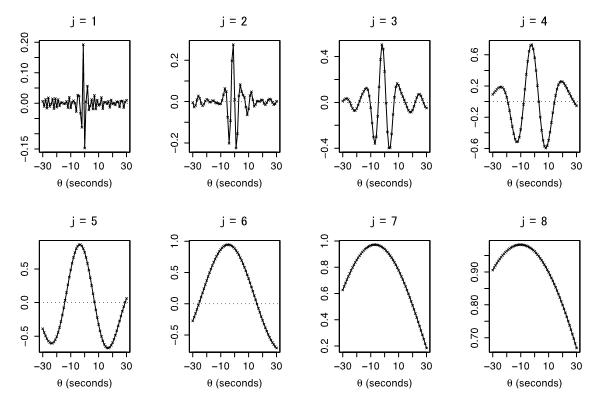

Takaki Hayashi, Yuta Koike, Wavelet-based methods for high-frequency lead-lag analysis, SIAM Journal of Financial Mathematics, Vol. 9, No. 4, pp. 1208-1248 (2018).